Not known Details About Tax Amnesty

Wiki Article

The Greatest Guide To Tax Avoidance Meaning

Table of ContentsOur Tax Amnesty 2021 IdeasTaxonomy Fundamentals ExplainedNot known Incorrect Statements About Tax As Distinguished From License Fee Excitement About Tax As Distinguished From License FeeLittle Known Facts About Tax.The Tax Avoidance PDFsThe Basic Principles Of Tax Avoidance

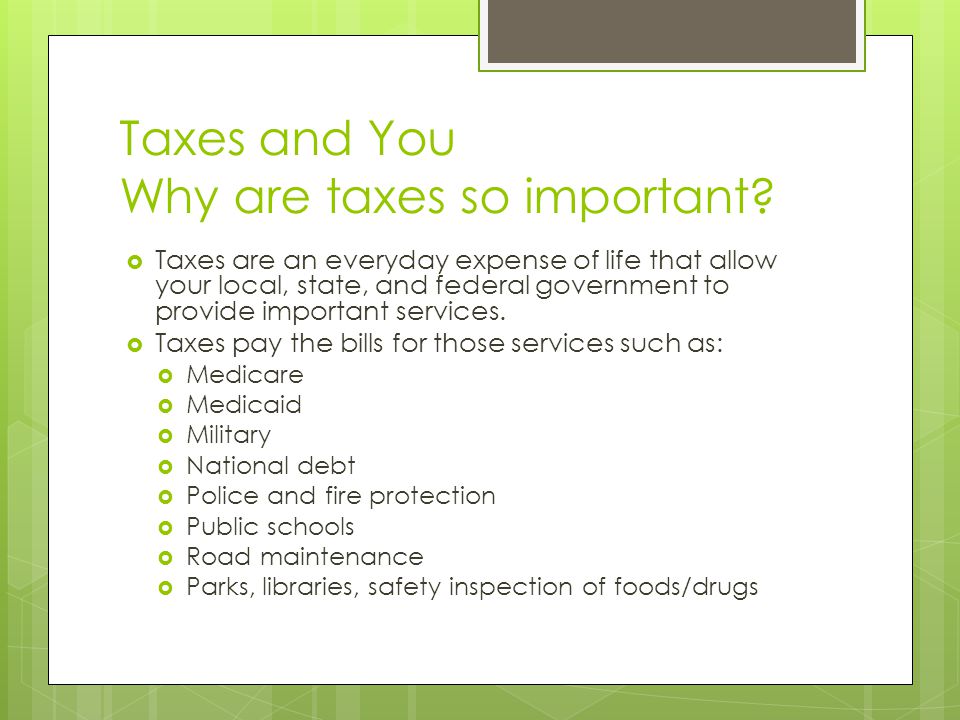

Further Analysis, For a lot more on earnings tax obligation, see this Northwestern Legislation College post as well as this College of Chicago Legislation Evaluation article.Intro Throughout background, every organized society had some kind of government. In cost-free societies, the objectives of government have been to protect private freedoms and also to advertise the wellness of culture as a whole. To fulfill their costs, government demand revenue, called "revenue," which it elevates through tax obligations. In our country, governments impose a number of various kinds of tax obligations on people and services.

Tax As Distinguished From License Fee Can Be Fun For Anyone

Some services are much more efficiently supplied when federal government firms plan as well as administer them. Everybody advantages from these solutions, and also the most functional means to pay for them is through taxes, instead of a system of service charges.There are additionally policies to regulate such points as the usage of billboards and signs along freeways. The complimentary enterprise system is based on competitors among services.

To ensure that a degree of competitors exists, the Federal Federal government imposes rigorous "antitrust" laws to stop any individual from obtaining monopoly control over a market. Some solutions, referred to as "natural monopolies," are more effectively given when there is competition - tax. The best-known examples are the utility firms, which provide water, gas, and also electricity for home as well as service use.

Top Guidelines Of Tax Avoidance And Tax Evasion

The complimentary enterprise system thinks that consumers are experienced about the top quality or safety and security of what they purchase. For public security, government companies at the Federal, State, and also regional degrees concern and enforce policies.

An additional important form of consumer security is the use of licenses to stop unqualified individuals from functioning in certain areas, such as medication or the structure professions. City and also area governments have the main obligation for elementary and additional education and learning.

Federal gives used for performing research are an essential resource of money for institution of higher learnings. Given that the 1930s, the Federal Government has been providing earnings or services, typically called a "safety internet," for those in requirement. Significant programs consist of wellness services for the elderly and economic aid for the disabled and out of work.

The Single Strategy To Use For Tax Amnesty 2021

Taxes in the USA article Federal governments spend for these services with profits acquired by taxing three economic bases: earnings, intake as well as wealth. The Federal Government tax obligations income as its main source of revenue. State governments use taxes on income and also consumption, while local federal governments count almost entirely on tiring residential property as well as riches.A lot of the Federal Government's profits comes from revenue tax obligations. The personal revenue tax obligation generates regarding 5 times as much income as the corporate revenue tax obligation. Not all earnings tax taxed similarly. As an example, taxpayers having supply in a firm and then marketing it at a gain or loss have to report it on an unique routine.

Comparative, the passion they make on cash in a routine interest-bearing account obtains included with earnings, salaries and also various other "ordinary" revenue. tax accounting. There are also numerous sorts of tax-exempt and also tax-deferred cost savings intends available that impact on individuals's taxes. Pay-roll taxes are an important resource of revenue for the Federal Federal government.

The Ultimate Guide To Taxonomy

Staff members also pay into the social security program through cash held back from their incomes. Some state federal governments also use payroll tax obligations to spend for the state's joblessness compensation programs. Throughout the years, the quantity paid in social protection taxes has actually greatly raised. This is since there are fewer workers paying into the system for every retired individual currently getting advantages.Tax obligations on Consumption The most crucial taxes on usage are sales and also import tax taxes. Sales taxes generally get paid on such points as cars, garments and also movie tickets.

Instances of items subject to Federal import tax tax obligations are hefty tires, fishing equipment, plane tickets, gasoline, beer and also liquor, firearms, and also cigarettes. The objective of excise taxation is to position the burden of paying the tax on the consumer. An excellent example of this use excise tax obligations is the fuel excise tax.

Not known Incorrect Statements About Tax

Just people that buy gasoline-- who make use of the highways-- pay the tax obligation. Some items get taxed to prevent their usage. This puts on excise tax obligations on alcohol and also cigarette. Import tax tax obligations are additionally used throughout a battle or nationwide emergency. By raising the price of scarce things, the government can decrease the need useful link for these products.The majority of regions tax private houses, land, and also business click this residential or commercial property based on the residential property's worth. Generally, the tax obligations make money monthly along with the home loan payment. The one who holds the home loan, such as a bank, holds the money in an "escrow" account. Repayments then get produced the home owner.

Rumored Buzz on Tax

Those with high taxed incomes pay a larger percentage of their earnings in taxes. Considering that those with higher taxed incomes pay a higher portion, the Federal earnings tax is a "modern" tax.Report this wiki page